Pay lump sum off mortgage calculator

Choose the frequency with which you repay your loan keeping in mind that more frequent mortgage repayments will reduce the interest paid as well as the life. 11 instead of 11.

Pay Off Mortgage Vs Invest Calculator

You can also request a recast which will adjust your monthly payment to reflect the new balance depending on the amount.

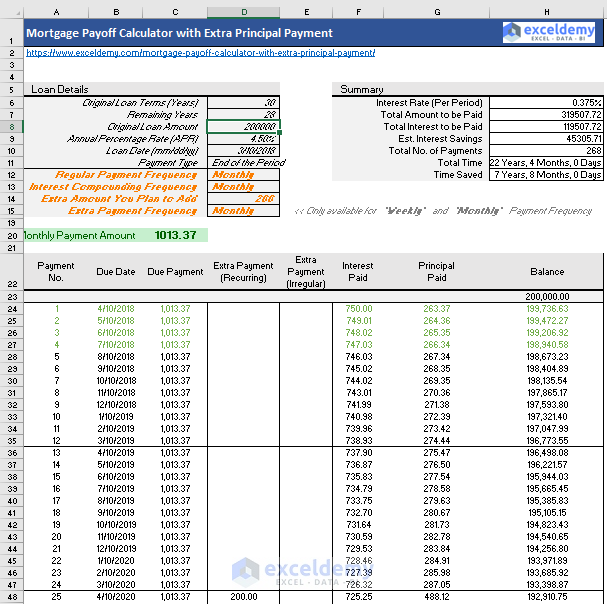

. This calculator allows you to enter an initial lump-sum extra payment along with extra monthly payments which coincide with your regular monthly payments. Extra mortgage payments are generally applied to your principal so that they shorten the amount of time it takes to pay off your. We also offer three other options you can consider for other additional payment scenarios.

Make a One-Time Lump-Sum Contribution. Make sure that your mortgage doesnt charge prepayment penalties before making a lump-sum payment. You decide to make an additional 300 payment toward principal every month to pay off your home faster.

If you can afford to make extra payments overpaying your mortgage means you pay less interest in the future and pay off your mortgage sooner. Lets see how this would impact our earlier. Depending on the amount you can also apply for a recast and have your monthly payment changed based on the new balance.

DIY extra payment to prepay mortgage Lets say you want to budget an extra amount each. At CalcXML we developed a user friendly loan pay off calculator. Make lump-sum payments whenever you have a few spare dollars.

If you pay multiple large lump sum payments you could pay your loan off years sooner. Another payment strategy you can do is to make a large lump-sum payment. Lets say your remaining balance on your home is 200000.

See how early youll pay off your mortgage and how much interest youll save. Mortgage recasting is different from refinancing because you keep your existing loan pay a lump sum toward the principal and your lender then adjusts your amortization schedule to reflect the new. Comparing mortgage terms ie.

Present Value Discount Rate. There are a few ways to pay off a mortgage sooner than the 30-year term. Refinance with a shorter-term mortgage.

Present Value of Money. Use the interest rate at which the present amount will grow. A lump-sum deposit provides the most substantial impact especially if it is applied shortly after taking out a new mortgage.

What is the maximum Lump-Sum Can I Pay Off My Mortgage. Paying off debt such as a mortgage auto loan or credit card debt is one consideration. Mortgage Calculator exe file - click the link and immediately run the mortgage calculator.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. RefinanceOr Pretend You Did. Youll pay down your loan early by 3 years and 9 months.

This calculator will help you to measure the impact that a lump sum repayment made at a certain period into the loan will have on the length of your mortgage and the total interest paid. Another way to pay off your mortgage early is to trade it in for a better loan with a lower interest rate and a shorter termlike a 15-year fixed-rate mortgage. Applying an Extra Lump Sum Payment.

However fixed-rate mortgages typically have an annual overpayment limit of 10 of your TOTAL outstanding mortgage balance. A lump-sum deposit has the greatest impact especially if it is made soon after a new mortgage is taken up. Making one additional monthly payment each year.

How can I pay off my 30-year mortgage in 15 years. You can get a lump sum after receiving inheritance benefits or a windfall from a business venture. Enter it as a percentage value ie.

Use it to see how quickly you can pay off your loan. It immediately reduces your principal compared to diminishing it in monthly increments. Pay extra each month.

Extra Mortgage Payments Calculator. On a 150000 mortgage at 5 with 25 years remaining paying off a 5000 lump sum reduces the interest by 11500 and means you would repay it 18 months earlier. Make a lump-sum payment toward the.

If your balance at the end of the year is 100000 the maximum lump sum payment for that year would be 20000. Enter the dollar amount as the future lump sum. Pay off higher interest rate credit.

Mortgage Calculator zip file - download the zip file extract it and install it on your computer. Calculator for Lump-Sum Mortgage. NerdWallets early mortgage payoff calculator figures out how much more to pay.

You can use a lump sum extra payment calculator to calculate how much money you can save with a lump sum payment. Lets assume you make a one-time lump-sum payment of 1000. Pay yourself by paying off debt.

How do I maximize my employer 401k match. If youve received a lump-sum payment from an inheritance tax refund or commission from a sale youre probably considering how to best use the money. If you are still in.

Pay off other debts. Most mortgages will allow you to prepay up to 20 of the principal every year free from any fees and you can take advantage of this to pay your mortgage off faster and save money should you come into some extra cash. Each month the extra 200 will pay down the principal of your loan and help you pay it off more quickly.

This means you could save a lot of money. A mortgage in itself is not a debt it is the lenders security for a debt. Should I refinance my mortgage.

This is the best option if you are in a rush andor only plan on using the calculator today. Most closed mortgage products allow a once-per-year lump sum payment of up to 20 of the remaining principal amount or balance. For example lets assume you have 50000 in student loans at a 7 interest rate.

An added lump sum payment has the greatest impact if you pay it soon after taking your mortgage. If you make one entire additional mortgage payment per year with a bi-weekly payment schedule it will take twelve years to pay an additional years worth of your mortgage. Your current principal and interest payment is 993 every month on a 30-year fixed-rate loan.

The amount of money you have to invest now in order to reach your lump sum goal in time. What are my lump sum distribution options. You can save significant money on your student loans with a lump sum payment.

Based on our example youll pay your mortgage off a year early saving over 6000 in the process. If you get an unexpected bonus from work or an inheritance you can quickly apply it toward the principal owed on your home. The loan is secured on the borrowers property through a process.

15 20 30 year. Bi-weekly payments instead of monthly payments. Th mortgage payment each year.

A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan. Pay off your mortgage early by adding extra to your monthly payments. This is the best option if you plan on using the calculator many times over the.

Options to pay off your mortgage faster include. Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien. If youre on your lenders standard variable rate or youre on a tracker mortgage there is normally no limit on how much you can overpay your mortgage by.

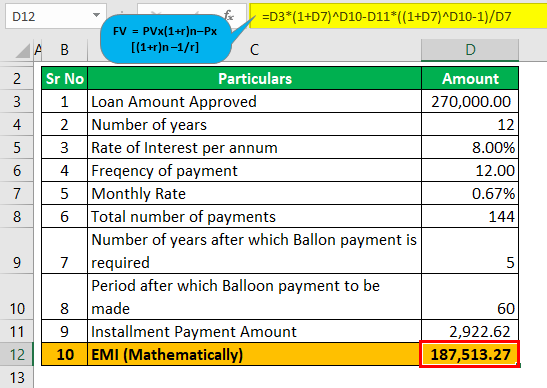

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

Balloon Mortgage Calculator How To Calculate Balloon Mortgage

Mortgage Recast Calculator To Calculate Reduced Payment Savings

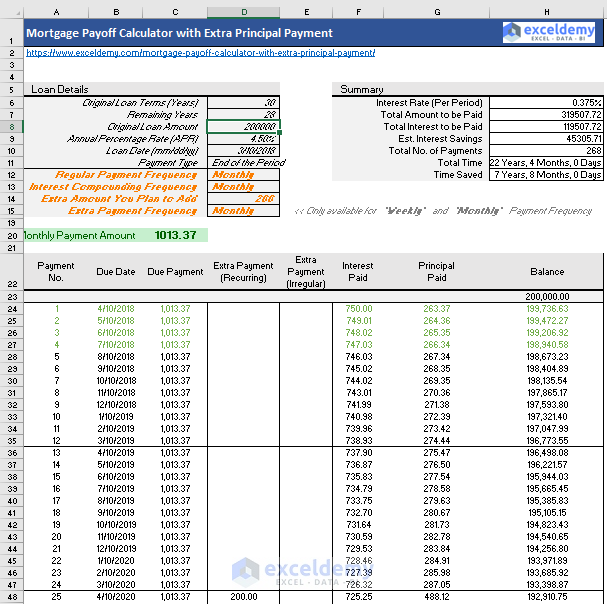

Extra Payment Mortgage Calculator For Excel

Reverse Mortgage Calculator

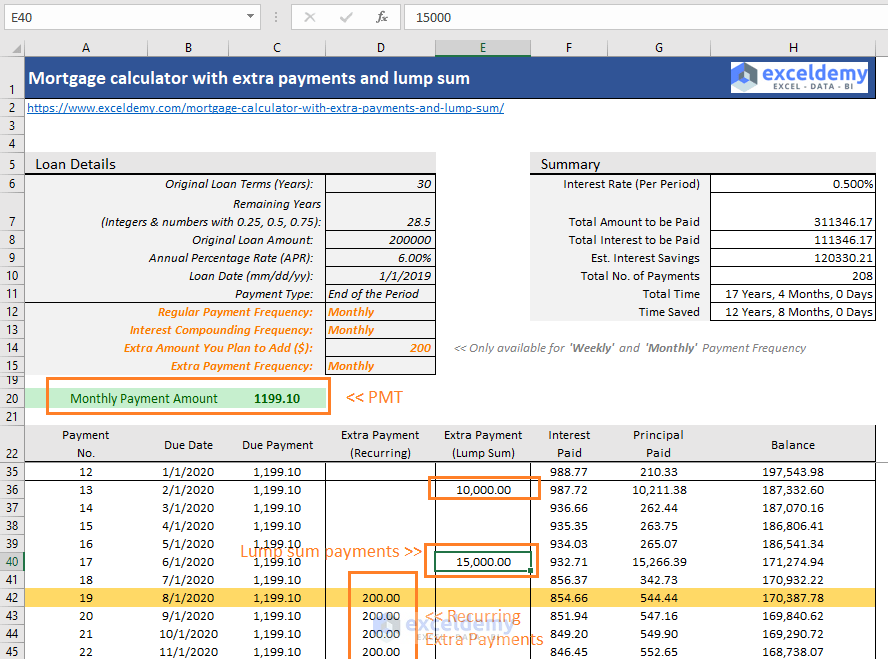

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Reverse Mortgage Calculator

Mortgage Calculator With Extra Payments Payment Schedule

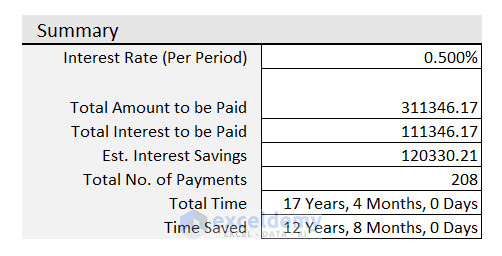

Mortgage Payoff Calculator With Extra Principal Payment Free Template

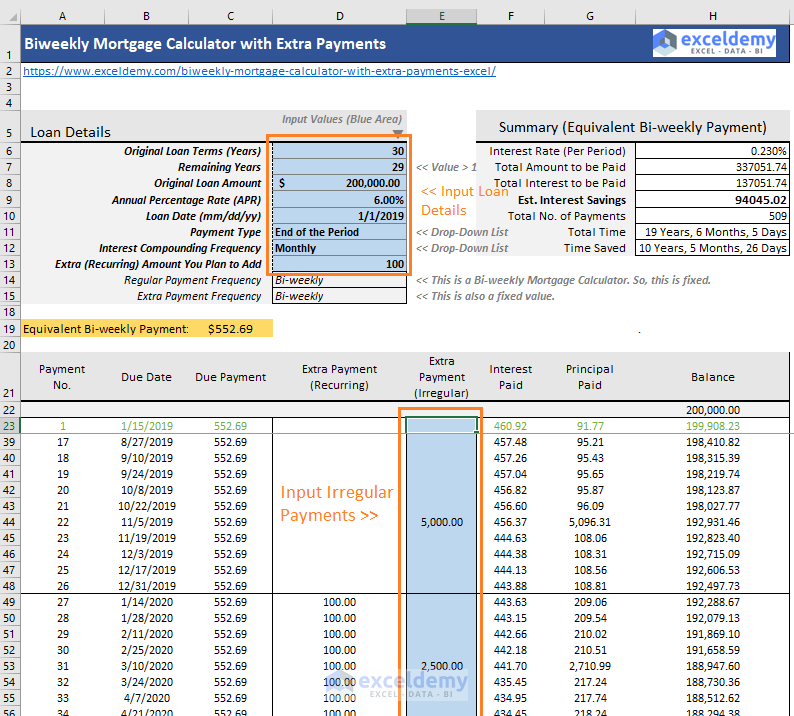

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Reverse Mortgage Calculator Mls Mortgage Reverse Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator

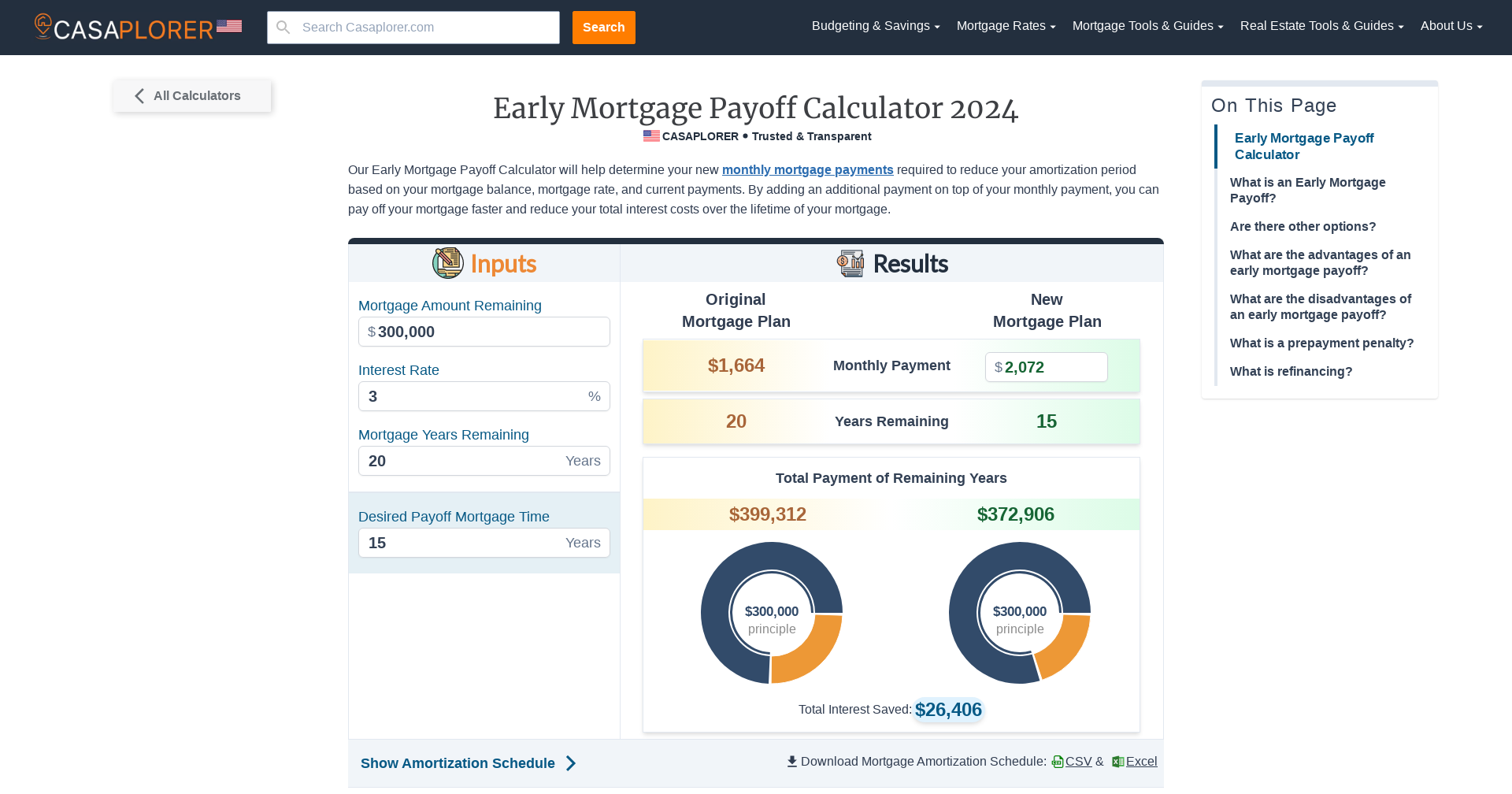

Early Mortgage Payoff Calculator 2022 Payoff Your Mortgage Early Casaplorer

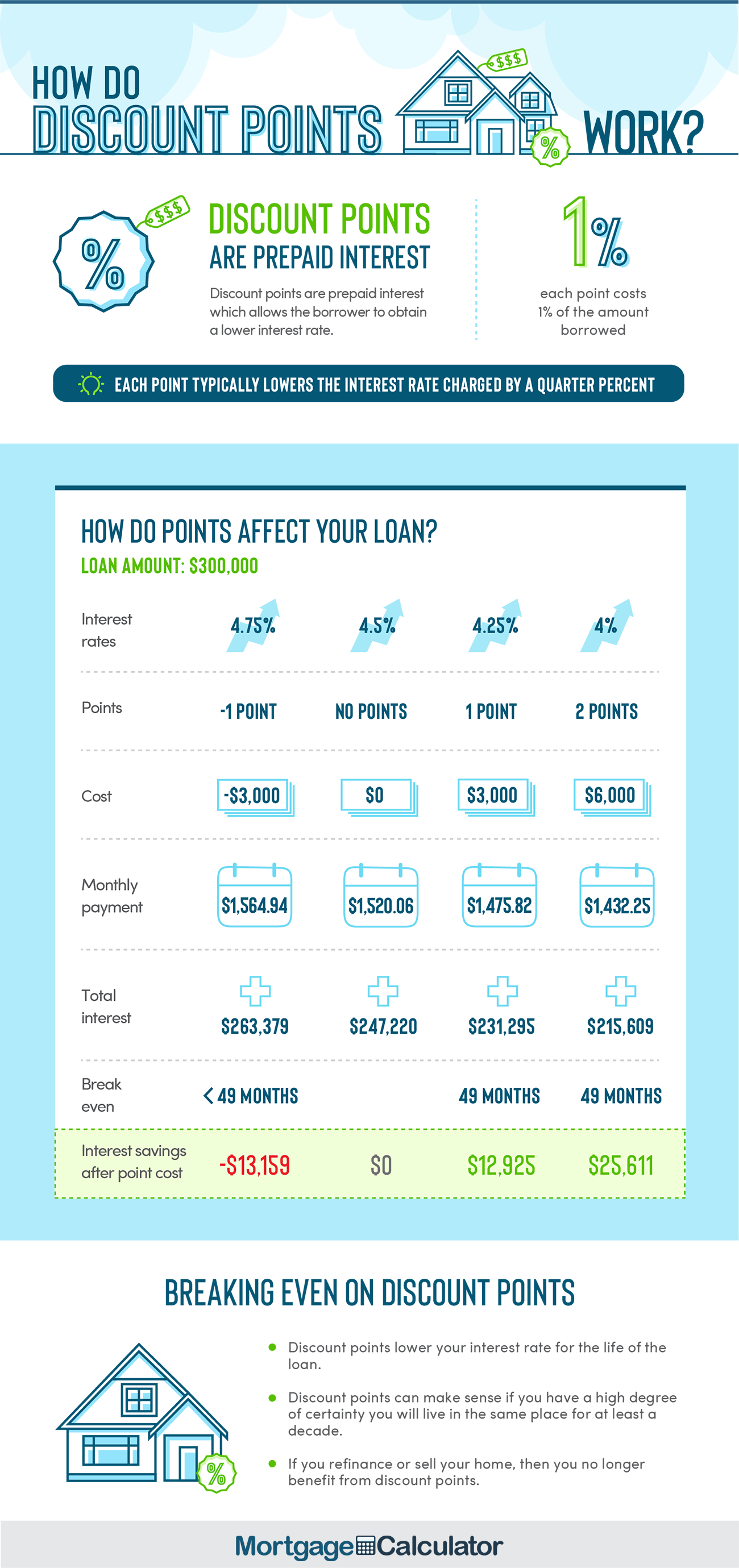

Discount Points Calculator How To Calculate Mortgage Points

Mortgage With Extra Payments Calculator

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template